There are two parts to this post, the first on Mark Carney's speech on the Canadian housing market, the second on new legislation surrounding CMHC.

As promised, I will cite what I consider a few key passages from Mark Carney's speech (PDF) to the Vancouver Board of Trade today. Emphasis is mine.

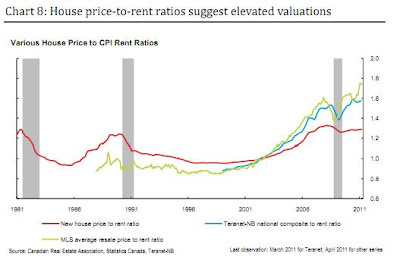

The single biggest investment most Canadian households will ever make is in their home. Housing represents almost 40 per cent of the average family’s total assets, roughly equivalent to their investments in the stock market, insurance and pension plans combined. In recent years, housing has proved a very good investment indeed. The value of residential real estate holdings in Canada has climbed more than 250 per cent in the past 20 years, vastly outpacing increases in consumer prices and disposable income over that period.However, Canada is arguably no better off because of it. That’s because while homeowners may feel wealthier because of this rise in prices, housing is not net national wealth. Some Canadians are long housing; others are short. Housing developments can have important implications for equality both across and between generations. Though some people in this room may have been enriched, their children and neighbours may have been relatively impoverished…With this renewed vigour building on the decade-long boom that preceded the crisis, the average level of house prices nationally now stands at nearly four-and-a-half times average household disposable income. This compares with an average ratio of three-anda-half over the past quarter-century. Simple house price-to-rent comparisons also suggest elevated valuations. While neither of these metrics reflect the impact of low interest rates, even after adjusting for these effects, valuations look very firm. For example, the ratio between the all-in monthly costs of owning a home and renting a home, as measured in the CPI, is close to its highest level since these series were first kept in 1949.Financial vulnerabilities have increased as a result. Canadians are now as indebted (relative to their income) as the Americans and the British. The Bank estimates that the proportion of Canadian households that would be highly vulnerable to an adverse economic shock has risen to its highest level in nine years, despite improving economic conditions and the ongoing low level of interest rates. This partly reflects the fact that the increase in aggregate household debt over the past decade has been driven by households with the highest debt levels.Some excesses may exist in certain areas and market segments. In particular, the elevated level of “multiples” inventories, the ample pipeline of developments under way, and heavy investor demand (much of it foreign) reinforces the possibility of an overshoot in the condo market in some major cities…In the Bank’s view, Canadian housing market developments in recent years have largely reflected the evolution of supply and demand. While supply of new homes should remain relatively flexible, many of the supportive demand forces are now increasingly played out.For example, while measures of housing affordability remain favourable, this is largely because interest rates are unusually low. Rates will not remain at their current levels forever. The impact of eventual increases is likely to be greater than in previous cycles, given the higher stock of debt owed by Canadian households. At a 4 per cent real mortgage interest rate—equivalent to the average rate since 1995—affordability falls to its worst level in 16 years…The Bank has been expecting moderation in the housing sector as part of a broader rebalancing of demand in Canada as the expansion progresses. Overall economic growth is expected to rely less on household and government spending, and more on business investment and net exports. Household expenditures are expected to converge toward their historic share of overall demand in Canada, with expenditures growing more in line with household income. In this context, the Bank anticipates a slowing in both the rate of household credit growth and the upward trajectory of household debt-to-income ratios.There are conflicting signals regarding the extent to which this moderation is proceeding. While growth in consumer spending slowed markedly in the first quarter, housing investment re-accelerated, as did household borrowing, with mortgage credit growing at a double-digit annual rate. It is likely that some of this resurgence in borrowing is transitory, reflecting the lagged effects of the surge in existing home sales in the fourth quarter of last year, as well as recent changes in mortgage insurance regulations that may have resulted in some activity being pulled forward into the first quarter. Mortgage credit growth slowed in April, reinforcing the view that the particularly strong increase in borrowing in the first quarter was temporary. Nonetheless, at a 5 per cent annual rate, growth in mortgage credit in April was slower but not slow, particularly given the sustained above-trend increases of recent years.

Overall there is not much earth-shattering in the speech for those who have followed this blog for a while. Chart 19 is used by Carney to highlight a divergence between new home prices and existing home prices as adding uncertainty in tracking the housing market. One thing to remember here is that the NHPI is more heavily weighted to certain regions of the country where large-scale developments are more common. Vancouver is relatively sparse in terms of these types of developments so the deviation between the Teranet HPI and the NHPI can at least be partially explained by Vancouver's increasing share of influence over the Teranet index.

Carney points out that the share of indebtedness has been borne by more recent homebuyers who have had to take on larger debt loads to "keep up" with rising prices. In other words, the ones setting the marginal prices have been taking on the largest levels of debt.

Carney additionally highlights that multiple unit inventory has been growing faster than single family units and certainly inventory levels in Vancouver of condo units seem to be more elevated than that of detached dwellings. If the experience in the US is any gauge, weakness in condo prices will precede weakness in detached prices, though one should remember that in Vancouver a "detached" dwelling is not necessarily synonymous with a "single family" dwelling.

This speech is an interesting insight into how the Bank of Canada is tracking the housing market and household indebtedness. By these measures it is clear the bank is not unaware of the basic long-term sustainable levels of house price-income, house price-rent, and debt-income ratios. My concern is that they underestimate the implications of the magnitude of these measures at current levels and their potential to fall below -- not necessarily return to -- their long-term averages.

A Big Bill

On a related note, and perhaps more important than the musings of an influential central banker, the federal government tabled a bill (the "Supporting Vulnerable Seniors and Strengthening Canada’s Economy Act"), within it the "Enactment of Protection of Residential Mortgage or Hypothecary Insurance Act":

"An Act to authorize, in certain circumstances, the making of payments or the purchase of replacement insurance by Her Majesty in respect of certain types of mortgage or hypothecary insurance provided by an insurance company in respect of which a winding-up order is made and to terminate certain agreements relating to mortgage or hypothecary insurance"

This bill is designed, as far as I can ascertain, to allow more specific and targeted oversight of nation-wide mortgage lending. Though I'm not a legislator by training, this Act appears to do the following, amongst other provisions (to paraphrase):

- The Ministry of Finance can impose additional capital reserve ratios on CMHC

- The Ministry of Finance can effectively revoke the ability of certain lenders from applying for government-backed mortgage insurance.

- CMHC must pay fees in accordance with elevated risk levels it incurs

- CMHC must open its books to the Ministry of Finance (it wasn't before?!?)

- CMHC's books will be available through FOI if not publicly displayed

- There is a 10% deductible to any funds that are paid by the government to backstop private mortgage insurers. CMHC is 0%

I have stated in the past I thought countercyclical capital reserves would become more pervasive as time elapses. Regimenting contercyclical capital reserves in primary mortgage insurance is a welcome change and one in-line with Carney's efforts on the international stage. Though not explicitly stated in the Act, given the breadth and authority explicitly given to the Ministry of Finance to influence CMHC's actions, there is provision to ensure that lenders who use, or plan on using, CMHC insurance, are making sustainable low-ratio loans.

I'm not sure current legislative framework but the 10% deductible on government-funded backstops is another welcome change to mortgage insurance, effectively requiring lenders to undertake, or at least consider, some of the burden associated with defaulted insured loans and consider counterparty default in their risk analyses.

4 comments:

Of course we should not underestimate that Flaherty may not know much better than anyone else what's going on. Here he is siding with Republicans on US deficit reduction, one assumes without higher taxes, in the hopes that cutting public sector jobs will balance the budget. Keynesian this is not.

It looks like Canada's in for an interesting 5 years.

I think your interpretation is correct, and this is the oversight of the mortgage monster that many have been calling for. Unfortunately it may be too late.

Ironically, the day after C-3 became law, Genworth MI Canada will pay out much of its capital cushion in a buyback!

cara judi sabung ayam agar menang

(the fight against poverty) Good morning Sir/Madam You have been refused at the bank because your credit does not meet

their standards? You dream of owning your own house, but you have been refused a mortgage because of a high rate

or

insufficient credit? Your business is down? Do you need money to boost your business?

explainable late payments, over-

indebtedness, divorce or loss of employment or other, You may have a

second chance at credit between individuals. did you

learn about the great loan campaign offered by Mr Remis Canales de Trans-

CIC-Banks? I'm telling you about it because it offers

loans of up to $150,000 at a very low rate of 2.59%, and it even

left 4 months before starting not refunded. Get in touch quickly

with Mr. Remis Canales if you have a good project that has

need funding

dgcanales22@gmail.com

+14503005817

Post a Comment