Sputter, sputter, cough, cough, okay, I have my tongue out of my cheek now!

Fraser Valley Real Estate Board statistics are out for the month ending April 30th, 2007. Sales are down 5% YOY and active listing are up 51% over last year. Active listings are at the highest level in 2.5 years.

Prices are up - a lot. Median detached is $480,000, attached is $312,500 and apartments are $210,000. Those Whalley condos are hot, hot, hot.

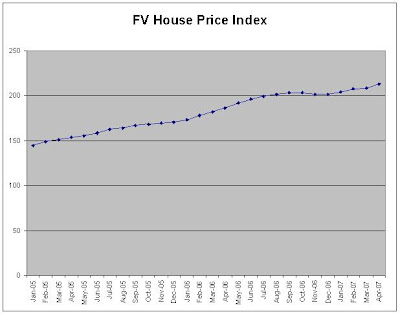

The house price index is up 2.2% MOM, 4.4% QOQ, and 14.4% YOY.

Months of inventory increased to 4.4 and the trend is up, up, up. Which means prices will go down, down, down. If this trend continues, the months of inventory will be over 10 by the end of the year. Choices galore.

The belief that these prices will hold is so prevalent now among most people I talk to and for some reason most people believe its a good thing. Contrarian psychological analysis would lead me to believe that we are very near the top of this market.

19 comments:

I figured that FV sales would have to be down, because GV sales are actually up. Since Chipman's area overlaps, both and his sales are down, that could only mean FV sales down. Some inventory runup. Nothing like Phoenix's 500%+ though. Yet.

And wow on prices. Local buyers either know something I don't (insert smartass comment here), or they are living in their own bubble, literally and figuratively. The unfolding story down south has absolutely no impact on the psychology. I guess the message that we are different must have successfully entered our collective psyches.

I don't know how people in the valley are able to support a median house price of nearly half a million, when median family income is 50k - 60k.

I figure that a fair number of buyers must be selling their place in the city, then buying out in the valley and pocketing the difference.

It's either that, or Mom and Dad helping out junior with a large DP.

" figure that a fair number of buyers must be selling their place in the city, then buying out in the valley and pocketing the difference."

But that should put downwars pressure on city prices, clearly not the case. Unless they are filled by other (offshore speculators etc)

The buyers have to be coming from somewhere. Everyone I know that has bought in the valley has been moving further east from where they work.

With the price compression that has happened, I don't see the benefit of saving 60k on a house, but now having 30-40 min. extra commute to work.

I talked to a couple more people today who were able to agree that the prices were not sustainable, but could not get their heads around the the thought of sustained price decreases. Then I ran into a realtor who assured me that there was no bubble, and prices could only keep going up.

Well, with sales down 5% and listings up 50% I think the stage is set for a hard crash.

Who is going to absorb a 51% increase in inventory YOY? Especially when sales are down 5% YOY? IMO, the top of this real estate craze will hit within the next couple of months.

As inventory sits there unsold, there will be an inevitable flattening of prices, and then the momentum will swing downwards. There is a lag effect on prices but prices will eventually succumb to basic supply and demand.

>freako said...

>And wow on prices.

There is a lag effect on prices. Prices will eventually trend as supply and demand dictates. I don't think it is possible for prices to continue to rise if the trend is lower sales with an increase in inventory.

With a rapid increase in inventory (26% for REBGV and 51% for FVREB) and an increase in the median price heading towards summer, we are trending exactly like the U.S. in 2006. Note that the median price in the U.S. hit a high in July of 2006 and from there ... well ... we know the rest of the story.

"National home sales and prices both fell dramatically in March 2007—the steepest plunge since 1989—according to NAR data, with sales down 13% to 482,000 from the peak of 554,00 in March 2006 and the national median price falling nearly 6% to $217,000 from the peak of $230,200 in July 2006." Source: http://en.wikipedia.org/wiki/United_States_housing_bubble

For what its worth, I think the run up early 07 (into to already extremely poor affordability) will open the possibility of a very sudden reversal. In other words, no neat flattening out that we can see from a mile away. Why do I think so? Because this demand is buying in unison. Think big crush of people trying to get into a venue. Once they are all in, few stragglers.

freako,

I'd like to agree, but it seems like this has been the thinking (at least from bears) for the last 18 months, so who knows.

The higher prices go the more likely the 'sudden reversal' becomes. In my view, and I believe history would prove me accurate, if the market is irrational on the way up it will be equally irrational on the way down.

"I'd like to agree, but it seems like this has been the thinking (at least from bears) for the last 18 months, so who knows. "

I was mostly thinking about the steady slide September through January, and then the 9% appreciation February through April. It is like buyers went home, scrounged up more financing, and then took a bull run. In unison.

Maybe that has happened before, dunno. In either case, tendency of buyers to act in unison, just means that things can change quickly - in either direction. If the charge vanes as new supply enters the market, the impacts at the margin could be larger than we are used to. Like a 5% single month drop. Pure speculation of course. All I am saying is that the top may not be a nice round hill, but rather a precipitous peak.

I had a chance to put the new data into my analysis model and its interesting that my price prediction model now computes a price peak in July and YOY price declines in December.

This is worse than I thought. Even Chipman area's listings are going down. Maybe we called the top too soon? What's going on? I am absolutely confused about this new strong upsurge........any ideas?

I don't think we're going to see significant changes till the fall, precipitated by events in the US. There's a lot of volatility going on right now, and I wouldn't put too much faith in any single movement.

The worrying thing IMHO is the anecdotal reports of a tight rental market. With all the construction, and relatively meek population growth, we should have excess housing units, which should increase rental supply and hold the line on rents.

I understand that some units are taken off the market for renovation demolition. Also that some speculators keep empty units. But still, that can't account for the missing housing stock can it?

Anyhow, when the NAR releases its report I will post a chart showing how Vancouver fits into the Nort American RE landscape.

"Even Chipman area's listings are going down."

This is because of month-end expires.

As to the tight rental market, it is possible low unemployment is allowing people to "de-densify." I don't know how much dormant rental supply is out there but I do know that rising unemployment causes people to "densify" to save $. Could also be some eviction notices with intent to sell are crimping supply.

We know the dwelling count has been increasing faster than population nationwide for several years. I cannot explain it other than pointing at the 800lb gorilla.

Post a Comment