What is Asset Allocation?

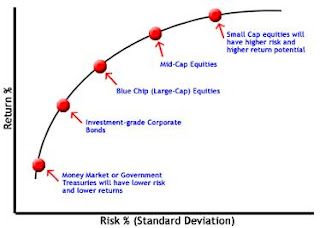

First off, asset allocation is simply the decision an investor makes about what percentage of his/her assets will be invested in a specific class of investment vehicles. The different investment vehicles would commonly include:

- Cash (bank accounts, cash balances, t-bills and other money market instruments)

- Fixed Income (government bonds, corporate bonds, high-yields bonds, and GICs,)

- Large Capitalization Equities ($10 billion + corporations with large and typically stable businesses, large companies typically pay dividends)

- Mid-Cap Equities (mid-sized companies of $1 to $10 billion capitalization)

- Small-Cap Equities (small companies with capitalization of less that $1 billion)

- Canadian Equities (companies with a stock listing in Canada)

- US Equities (companies with a stock listing in the USA)

- International Equities (companies with stock listings outside of North America)

- Emerging Markets Equities (companies with stock listings outside of the developed world)

- Real Estate (land and/or buildings)

- Art, Collectibles, and Precious Metals

- Futures, Options, Short Selling

Note: Typically, real estate, art, collectibles, precious metals, futures, options, and short selling are all considered 'more risky' or more volatile even than small-cap stocks.

Why is Asset Allocation so Important?

Asset Allocation is important to the investor for one main reason, that is, it can ensure the investor is in an appropriately balanced portfolio for his or her risk level. For example, a young professional with a high income and a long time before needing his/her investment funds, may be able to accept higher volatility in his/her portfolio, thus allowing a greater allocation to stock based investments. Or conversely, an elderly retiree may need a regular income from his/her investments and may not be able to accept higher volatility in his/her portfolio.

This first investor should probably have a higher weighting to stock based investments because of the long time horizon and the potential for much higher returns (say 8% for stocks and 4% for fixed income) and the second investor should have minimal exposure to stock based investments because of the potential volatility. These are general guidelines of course and do not constitute specific investment advice for your particular situation.

What is the right Asset Allocation for me?

This is a difficult question and a very personal one but the quick answer is that your asset allocation should change based on three things:

- Your personal willingness to accept volatility in your investments - be honest - how would you feel if your investment lost 10% in six months? What would you do?

- Your time horizon. How long before you need the money?

- Your amount or ability to absorb losses. How much money can you afford to lose before it would affect your lifestyle?

I hope that helps and I look forward to hearing your comments or answering your questions.

3 comments:

It has been said that asset allocation can account for over 90% of a portfolio's return. I am not sure whether this is true or not because of studys which dispute that number. What I do know is that asset allocation has a big impact on a portfolio's rate of return. The exact percentage of impact is unknown.

Blogger...

Off topic question. If you had say 6 million in a trust.

What would be a decent return per year if you want it in safer investment vehicles? Nothing very volitile. I guess you can be fairly deverse with this sum.

thanks

good question paul -

Typically in my financial plans, I would say for a very conservative portfolio of 80% fixed income and 20% equity that a 6% rate of return should be achievable over the long run.

If you were willing to move up the risk scale to a portfolio of 60% fixed income and 40% equity then a 6.5% rate of return over the long run would be very acheivable.

If you have a professional investment manager who is managing that sum of money for you then I would expect them to be very interested in choosing investments that are suitable for that specific situation as well as keeping the investment manageemnt fees low.

Post a Comment