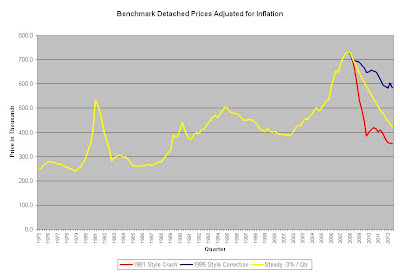

Here is a pictoral illustration to give some food for thought - click to enlarge.

If we accept the premise that housing in Vancouver is overvalued based on fundamental analysis of the assets and the earnings or imputed earnings that these assets can earn, then we must evaluate how this overvaluation will be corrected.

Will earnings / rents grow to meet current prices? This would require a near doubling of local rents. I think most people would agree that this would devastate the local economy as the labour pool would dry up rapidly and many businesses would shut down due to the expense of operating here.

Will prices undergo a minor correction while rents increase modestly and interest rates are lowered? This is possible although trouble in the internation mortgage and credit markets would indicate that lenders may be unwilling to lend money to purchase real estate.

Will prices correct very quickly thus restoring a fundamental valuation to local real estate assets? This is also possible and perhaps even the most likely outcome given several possible events.

Here is the way I see things:

As the US enters recession it is likely to effect many industries here in Vancouver. This, combined with a wrapping up of several mega projects (Canada Line, Highways Improvements, Convention Centre, Condo Developments) during the next 12 - 18 months will drive unemployment up rapidly.

This unemployment will cause two things:

1) Developers will fast-track current housing projects as labour becomes available and

2) Unemployed or underemployed workers will leave and / or put up their homes for sale as they are unable to make the payments.

A wildcard in all of this is the amount of 'speculator owned' housing inventory out there. It is impossible to quantify at this moment but, if anecdotes are to be proved correct, this accounts for perhaps tens of thousands of underutilized or unutilized housing stock that could be put onto the market very quickly.

What do you think?

20 comments:

We have seen that it is possible for price declines some cities even when unemployment is low. Unemployment will likely be the twisting of the sword in the wound.

I'm not arguing that a correction requires unemployment but rather that I feel a 'rapid correction' requires some kind of trigger. In the US it was a massive amount of mortgage resets and here we may get a big uptick in unemployment with forestry, tourism, and film in the dumps we may not have to wait long.

A correction can happen with 100% employment.

I think it will happen fast. There is so much negative world news in reagrds to RE and world markets that you have to be a complete moron not to notice ( I may be presuming too much with Vancovuer psychology).

The reason I think it will happen fast is the rampant speculation. Soooo many people are holding properties that are bleeding them. I know of two people that are kicking in and extra $500 a month and more to break even on their "investment" properties. They think they are brilliant cause it keeps going up. But what will these people think when all of a sudden the news reports show no increases anymore, they will dump and run ( the smart ones anyways).

If I suspected that 90% of Van RE was bought by people who either needed a place to live or bought with sound fundamentals ( cash flow +) Then I wouldn't be too sure of a fast correction. But I'm fully confident that pure speculation is about 25% and at least an additional 20% of people only bought a home "to make money" not just to own a home.

There are a lot of people I know that are paying WAY more per month for a place to live only because they think they are getting rich. If their place doesn't appreciate at all or even drops a tad, they may think twice and want to get out cause they are sick of eating Kraft dinner to get by.

I personally think it will happen fast. Seems to be the nature of Vancouver boom and bust cycles.

Mohican

"In the US it was a massive amount of mortgage resets " Was that the actual trigger though? Prices started dropping before that no? The people with massive resets could have just sold at a profit and walked once the resets started. I thought the prices started collapsing under thier own weight first?

DaMann - you are correct - prices began stagnating and then correcting under their own weight first. The rapid price declines happened once the trigger occurred - mortgage resets.

Perhaps trigger isn't the right word for me to use. I am thinking that catalyst is a better word to describe the role that mortgage resets are playing the US housing market.

The 'reaction' - declining house prices was already underway and that 'reaction' was accelerated by the catalyst. I am arguing that our catalyst will be unemployment and that we need some sort of catalyst for the price declines to be rapid.

ok I got yah

I think that speculation will be the trigger and the catalyst.

However I think your catalyst is well under way. Forestry is done, tourism will be dry from the US cause of the dollar. Movie industry is flat, even if the writers strike ends tomorrow the new scripts are a while away. Of course the biggest is the contruction industry, which will die quick once the building stops when the market slows.

A house of cards indeed.

I think the insane over valuation of the market will be all the catalyst it needs to drop quickly Mohican.

My call is a roller coaster, not much like the '90s or the '80s crashes. More of a quick drop followed by a lull that lasts several months, perhaps repeated 2 or 3 times, then if you're watching the graph your stomach will give a big lurch as the whole thing falls off a cliff. Perhaps another jolt or two upwards on the way down, finally bottoming out at around your 200 line then gradually making it's way back to the 250 range.

If you're talking about catalysts I'd look at tightened credit standards. It could be that someone gainfully employed who last year would have qualified for a certain loan amount now cannot even qualify, regardless of the spread.

Mohican,

First all, many thanks for the blog and picking up from VHB.

A couple of points:

1)Vancouver has been has been singled out as one of the largest bubble cities in America by some very well respected (now!) economists.

Once we start losing RE industrial complex jobs there really isn't much left (latte before yoga class, fries with that? etc.)

2)CMHC and even the esteemed Bob Rennie suggest "investors" buy over 50% of condos. Investments don't usually involve neg. cash flow, but what do I know, I rent.

3) A Bank of Canada historical study highly correlates US and Canadian Real estate the main difference being a delay but a faster and steeper decline.

Saying that , what do the banks know. Look at CDOs and CDS markets now.

If you guys don't already, read Mishs Global Economic analysis as well as Calculated Risk; in a nutshell the next few years are going to be very, very tough. Real estate investments will be the least of our worries.

" Vincit qui Patitur"

I think the correction will not be homogenous. Fraser Valley prices will see some dips but overall a slower correction in detached. We are already seeing the first signs of this with increased inventories. I'd expect a long U-shaped curve bottoming out at 10-15% at most. Reason why is that there hasn't been nearly as much speculation there as in the Vancouver hotspots. I'd hate to be stuck with a box in the Inifity tower, though. A slowdown here, though, could really trigger headlines, which could set off the condo market.

For Van West, West Van and Vancouver Condos, I see a major, precipitous drop as things will correct quickly. I see a jagged, sharper decline down to a bottom (probably in 2011) of 20-25%, hopefully more, especially in condo markets (30%+?).

As for trigger, I think the big one will be the condo market in Vancouver. That's where most of the speculators are. The "bright" ones will pre-empt the Pre-Olympic sellers, and it will snowball from there. These guys are not owners, just speculators, many with no cash flow. These are essentially, non-dividend stocks, waiting to be flipped, and the sell-off will be epic. Then the headlines will come, followed by stories of people in bankruptcy because they bought 2 or 3 pre-sales and were left holding the bag.

With the buildup we've seen, I wouldn't be surprised to see a long local recessionary environment where little residential construction occurs, leading to a period like the 90s where you couldn't make money in RE.

I foresee a slow start to the crash starting in the late summer, with the GVRD benchmark SFH posting 0% YOY, and a slow decline beginning in the fall. This will be the market sagging under its own weight.

I agree with most of the factors that will kick the decline into gear, but I want to write them out for myself again:

-The pre-sale market is rumoured to have slowed to a crawl in the last couple of months. This will cause partially-sold builders to cut their profit margin on unsold units-- they need to sell enough units so that their bank will fund the construction loans to get the project off the ground.

-Major infrastructure and Olympic construction projects will begin completing, with reduced labour requirements towards the end of construction.

-Terminated labour will find employment on condo construction projects, allowing them to complete more quickly.

-The pre-sale situation will be degrading rapidly. Any developer without enough sales, or without significant enough deposits from pre-sale buyers won't be able to secure funding from the banks, which will be suffering from writedowns due to the credit crunch. Those unfunded developments will be cancelled, much like Elise. These developers will end up laying off staff, and won't be hiring any labour for construction.

-Funded condo projects will be getting completed more rapidly, resulting in labour lay-offs at completion.

-Lack of new projects in the pipeline due to the credit crunch will result in that unemployed labour staying unemployed. These workers will have sold, or will be desperately trying to sell their homes/investments.

-Projects completing will find few "investors" willing to fulfill their end of the purchase contract, resulting in developers slashing prices to sell units so that they can make their payrolls and service their debts.

-Some developers will go bankrupt, abandoning nearly-completed projects too early, leading to bank failures.

-Purchasers who WANT to buy will find it difficult to secure a mortgage, particularly with any significant amount of leverage.

-Lack of new projects will reduce demand for steel, copper, concrete, etc. Combined with the North America and European recession, and completion of lots of major (Olympic and World's Fair) projects in China, this will depress products of mined products, leading to layoffs in BC's other important sector, mining, leaving not a whole heck of a lot else to bring money in.

-With the general Western-world recession, if it also spreads to China, oil prices will come down considerably, bringing new oil exploration to a halt.

Oh, it will be exciting! ...And a little scary, too!

"they need to sell enough units so that their bank will fund the construction loans to get the project off the ground."

Good call. Incentives and free upgrades will be the first tactic, followed by "hidden" price cuts (no GST and no commissions), followed by simple raw price drops.

The gap between yields and prices are so large that I cannot help but foresee a rapid correction, preceded by a short term lull period. Affordability and tightening credit has pretty much put the brakes on the price increases. So, I think we are already starting the correction. After a couple of quarters of price stagnation or slight decreases, the specuvestors will start trying to bail out in mass, which will trigger more dramatic price drops as listings keep multiplying. Bad local economic news will just add fuel to the fire.

I am not sure whether the downtown condo market will lead off or not, but it seems that anecdotally, this is where the most speculators are located

Well it seems that the ONLY thing holding this market together is the expectation of rising prices. The moment it becomes clear that those are no more, it is Wiley Coyote time.

I still maintain that we have borrowed demand from the future. People currently in the market are motivated more by fear of rising prices than actual NEED for ownership.

Supply? Given the amount of speculators with negative cash flow there is lots of pent up supply. It remains to be seen whether these guys will unload in a panic, or go into denial and hang on as long as possible. I watched the end of another Flip That House episode, and as always the on screen flipper calculator suggests a $60,000 profit based on a realtors estimate. Then came the "update" and I was expecting a large loss (as we have seen lately on these shows). No loss because he didn't sell it, but rented it. What a moron.

Taking all this into consideration, it possible that our decline rivals 1981 in terms of speed and ruthlessness.

Well it seems that the ONLY thing holding this market together is the expectation of rising prices. The moment it becomes clear that those are no more, it is Wiley Coyote time.

I still maintain that we have borrowed demand from the future. People currently in the market are motivated more by fear of rising prices than actual NEED for ownership.

Supply? Given the amount of speculators with negative cash flow there is lots of pent up supply. It remains to be seen whether these guys will unload in a panic, or go into denial and hang on as long as possible. I watched the end of another Flip That House episode, and as always the on screen flipper calculator suggests a $60,000 profit based on a realtors estimate. Then came the "update" and I was expecting a large loss (as we have seen lately on these shows). No loss because he didn't sell it, but rented it. What a moron.

Taking all this into consideration, it possible that our decline rivals 1981 in terms of speed and ruthlessness.

A lot of these intial signs are already appearing in the Surrey/Langley areas.

Take Yorkston at 88th and 208th as shown in the photo of the previous blog entry. Lots of listings, many advertised with now no GST and $10K or more price cuts. Along with the developers units, there are two private listings, one a forclosure (never lived in for a year) and the other an estate sale. This will put a lot of pressure on the developer to sell the units that have been sitting completed since Nov/Dec.

There are multiple developments around the 192nd/72nd area that have pulled out from building completed houses and are now looking to just sell the lots, including some private sales on Craigslist. There are no signs on the lots advetising the sales, which I find strange.

There are signs of cracks everywhere in this area, with a huge oversupply already happening, but most people do not notice it.

I agree with most of what has been said, I look forward to some actual completions of major construction in condos and otherwise. It seems like things have been "under construction" for several years.

I wonder how much the planned city upgrades (for the Olympics) and the $14B provincial transit plan will buffer the economic blows. This is all assuming of course the government decides to keep on spending even though they will see decreased revenues. I honestly hope they do.

As to the question of how much of a decline, back in 2001 the ratio of median house price to median household income in Abbotsford was around 4.5. It's now at 7. Going back to 2001 would be a 35% drop, but if interest rates stay fairly low that may not happen. So I'll predict a 20% drop max, over a couple of years. If interest rates go up significantly, all bets are off.

Real estate investments will be the least of our worries.

Sort of depends on who you are. For me, yes. But for leveraged RE specuvestors, quite the opposite.

Post a Comment