http://www.cbc.ca/news/business/story/2011/06/29/housing-bubble-capital-economics.html?ref=rss

Interesting.

Wednesday, June 29, 2011

Teranet Index - April 2011

| ||||||||||||||||||||||||||||||||||

| The 12-month gain of the composite index was 4.4% in April, an acceleration from 4.1% in March. The largest 12-month rise was 7.5% in Ottawa, followed by 7.4% in Montreal, 5.8% in Vancouver, 5.3% in Halifax and 4.1% in Toronto. Though Toronto's 12-month inflation was the smallest, its market and Ottawa's were the only two to accelerate for a second consecutive month. Twelve-month inflation decelerated for a fourth consecutive month in Halifax. Calgary prices were down 3.5% from a year earlier, making April the seventh consecutive month of 12-month deflation. The large rise of the composite index in April may have been due to front-loading of sales to beat the announced shortening of the maximum amortization period for insured mortgages. In May, according to seasonally adjusted data from the Canadian Real Estate Association, home sales were flat from April in the major urban markets and market conditions were little changed - somewhat tight in Toronto, rather balanced on the whole. Teranet – National Bank House Price Index™ The historical data of the Teranet – National Bank House Price Index™ is available at www.housepriceindex.ca.

The Teranet–National Bank House Price Index™ is an independently developed representation of average home price changes in six metropolitan areas: Ottawa, Toronto, Calgary, Vancouver, Montreal and Halifax. The national composite index is the weighted average of the six metropolitan areas. The weights are based on aggregate value of dwellings as retrieved from the 2006 Statistics Canada Census. According to that census1, the aggregate value of occupied dwellings in the metropolitan areas covered by the indices was $1.168 trillion, or 53% of the Canadian aggregate value of $2.207 trillion. All indices have a base value of 100 in June 2005. For example, an index value of 130 means that home prices have increased 30% since June 2005.

1 Value of Dwelling for the Owner-occupied Non-farm, Non-reserve Private Dwellings of Canada. |

Thursday, June 16, 2011

Who is buying homes in Vancouver

From yattermatters:

Each month the Greater Vancouver Real Estate Board asks Vancouver Realtors® to respond to a survey. The survey is restricted to members who have made at least one sale in the preceding 30-day period.Check out Larry's blog for the data. We should remember that this is a survey so is prone to the usual survey errors, along with potential for uneven distribution of respondents to the actual buyer distribution -- think the 80-20 rule, where 80% of transactions are done by 20% of the members. Nonetheless the data provide invaluable insight into who the buyers really are and I'll let the numbers speak for themselves.Questions asked:How would you best describe your most recent buyer(s)?

- First Time Buyers

- Moving from one property to a similar property

- Moving from a condo to a townhouse

- Moving from a condo OR townhouse to a detached

- Moving from a townhouse OR detached to a condo

- Moving from a detached house to a townhouse

- Moving from a detached house to a condo

- Moving into a retirement home

- Local/Domestic investor

- Foreign Investor

How did the buyer(s) finance their purchase?

- All cash

- Conventional mortgage (25% or more downpayment)

- High ratio mortgage (less than 25% downpayment)

Describe the buyer(s)

- Single male

- Single female

- Young couple with no children

- Family with children

- Empty nesters

- Retired

- Other

Where did the buyer(s) move from?In your market area, are you seeing:

- Already lived in the same community

- Moved within the REBGV area

- Moved from the Fraser Valley Board area

- Moved from an area of BC outside the Lower Mainland

- Moved from outside BC, but still within Canada

- Moved from outside Canada

- More traffic at open houses?

- Deals collapsing due to financing?

- More multiple offers?

Wednesday, June 15, 2011

Carney on Housing (and some obscure bill)

There are two parts to this post, the first on Mark Carney's speech on the Canadian housing market, the second on new legislation surrounding CMHC.

As promised, I will cite what I consider a few key passages from Mark Carney's speech (PDF) to the Vancouver Board of Trade today. Emphasis is mine.

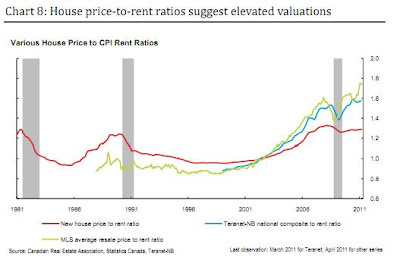

The single biggest investment most Canadian households will ever make is in their home. Housing represents almost 40 per cent of the average family’s total assets, roughly equivalent to their investments in the stock market, insurance and pension plans combined. In recent years, housing has proved a very good investment indeed. The value of residential real estate holdings in Canada has climbed more than 250 per cent in the past 20 years, vastly outpacing increases in consumer prices and disposable income over that period.However, Canada is arguably no better off because of it. That’s because while homeowners may feel wealthier because of this rise in prices, housing is not net national wealth. Some Canadians are long housing; others are short. Housing developments can have important implications for equality both across and between generations. Though some people in this room may have been enriched, their children and neighbours may have been relatively impoverished…With this renewed vigour building on the decade-long boom that preceded the crisis, the average level of house prices nationally now stands at nearly four-and-a-half times average household disposable income. This compares with an average ratio of three-anda-half over the past quarter-century. Simple house price-to-rent comparisons also suggest elevated valuations. While neither of these metrics reflect the impact of low interest rates, even after adjusting for these effects, valuations look very firm. For example, the ratio between the all-in monthly costs of owning a home and renting a home, as measured in the CPI, is close to its highest level since these series were first kept in 1949.Financial vulnerabilities have increased as a result. Canadians are now as indebted (relative to their income) as the Americans and the British. The Bank estimates that the proportion of Canadian households that would be highly vulnerable to an adverse economic shock has risen to its highest level in nine years, despite improving economic conditions and the ongoing low level of interest rates. This partly reflects the fact that the increase in aggregate household debt over the past decade has been driven by households with the highest debt levels.Some excesses may exist in certain areas and market segments. In particular, the elevated level of “multiples” inventories, the ample pipeline of developments under way, and heavy investor demand (much of it foreign) reinforces the possibility of an overshoot in the condo market in some major cities…In the Bank’s view, Canadian housing market developments in recent years have largely reflected the evolution of supply and demand. While supply of new homes should remain relatively flexible, many of the supportive demand forces are now increasingly played out.For example, while measures of housing affordability remain favourable, this is largely because interest rates are unusually low. Rates will not remain at their current levels forever. The impact of eventual increases is likely to be greater than in previous cycles, given the higher stock of debt owed by Canadian households. At a 4 per cent real mortgage interest rate—equivalent to the average rate since 1995—affordability falls to its worst level in 16 years…The Bank has been expecting moderation in the housing sector as part of a broader rebalancing of demand in Canada as the expansion progresses. Overall economic growth is expected to rely less on household and government spending, and more on business investment and net exports. Household expenditures are expected to converge toward their historic share of overall demand in Canada, with expenditures growing more in line with household income. In this context, the Bank anticipates a slowing in both the rate of household credit growth and the upward trajectory of household debt-to-income ratios.There are conflicting signals regarding the extent to which this moderation is proceeding. While growth in consumer spending slowed markedly in the first quarter, housing investment re-accelerated, as did household borrowing, with mortgage credit growing at a double-digit annual rate. It is likely that some of this resurgence in borrowing is transitory, reflecting the lagged effects of the surge in existing home sales in the fourth quarter of last year, as well as recent changes in mortgage insurance regulations that may have resulted in some activity being pulled forward into the first quarter. Mortgage credit growth slowed in April, reinforcing the view that the particularly strong increase in borrowing in the first quarter was temporary. Nonetheless, at a 5 per cent annual rate, growth in mortgage credit in April was slower but not slow, particularly given the sustained above-trend increases of recent years.

Overall there is not much earth-shattering in the speech for those who have followed this blog for a while. Chart 19 is used by Carney to highlight a divergence between new home prices and existing home prices as adding uncertainty in tracking the housing market. One thing to remember here is that the NHPI is more heavily weighted to certain regions of the country where large-scale developments are more common. Vancouver is relatively sparse in terms of these types of developments so the deviation between the Teranet HPI and the NHPI can at least be partially explained by Vancouver's increasing share of influence over the Teranet index.

Carney points out that the share of indebtedness has been borne by more recent homebuyers who have had to take on larger debt loads to "keep up" with rising prices. In other words, the ones setting the marginal prices have been taking on the largest levels of debt.

Carney additionally highlights that multiple unit inventory has been growing faster than single family units and certainly inventory levels in Vancouver of condo units seem to be more elevated than that of detached dwellings. If the experience in the US is any gauge, weakness in condo prices will precede weakness in detached prices, though one should remember that in Vancouver a "detached" dwelling is not necessarily synonymous with a "single family" dwelling.

This speech is an interesting insight into how the Bank of Canada is tracking the housing market and household indebtedness. By these measures it is clear the bank is not unaware of the basic long-term sustainable levels of house price-income, house price-rent, and debt-income ratios. My concern is that they underestimate the implications of the magnitude of these measures at current levels and their potential to fall below -- not necessarily return to -- their long-term averages.

A Big Bill

On a related note, and perhaps more important than the musings of an influential central banker, the federal government tabled a bill (the "Supporting Vulnerable Seniors and Strengthening Canada’s Economy Act"), within it the "Enactment of Protection of Residential Mortgage or Hypothecary Insurance Act":

"An Act to authorize, in certain circumstances, the making of payments or the purchase of replacement insurance by Her Majesty in respect of certain types of mortgage or hypothecary insurance provided by an insurance company in respect of which a winding-up order is made and to terminate certain agreements relating to mortgage or hypothecary insurance"

This bill is designed, as far as I can ascertain, to allow more specific and targeted oversight of nation-wide mortgage lending. Though I'm not a legislator by training, this Act appears to do the following, amongst other provisions (to paraphrase):

- The Ministry of Finance can impose additional capital reserve ratios on CMHC

- The Ministry of Finance can effectively revoke the ability of certain lenders from applying for government-backed mortgage insurance.

- CMHC must pay fees in accordance with elevated risk levels it incurs

- CMHC must open its books to the Ministry of Finance (it wasn't before?!?)

- CMHC's books will be available through FOI if not publicly displayed

- There is a 10% deductible to any funds that are paid by the government to backstop private mortgage insurers. CMHC is 0%

I have stated in the past I thought countercyclical capital reserves would become more pervasive as time elapses. Regimenting contercyclical capital reserves in primary mortgage insurance is a welcome change and one in-line with Carney's efforts on the international stage. Though not explicitly stated in the Act, given the breadth and authority explicitly given to the Ministry of Finance to influence CMHC's actions, there is provision to ensure that lenders who use, or plan on using, CMHC insurance, are making sustainable low-ratio loans.

I'm not sure current legislative framework but the 10% deductible on government-funded backstops is another welcome change to mortgage insurance, effectively requiring lenders to undertake, or at least consider, some of the burden associated with defaulted insured loans and consider counterparty default in their risk analyses.

Labels:

bank of canada,

CMHC,

debt,

interest rates,

jesse,

mortgage,

real estate,

risk management,

speculation

Tuesday, June 14, 2011

When Atlas Shrugs

It is rare that I listen more closely to people more than I do to central bankers and their entourage of economists, one because their words are clouded in nuance, two because their words are few and strategically meted. It so happens that Mark Carney will be giving a speech to the Vancouver Board of Trade tomorrow (Wednesday June 15 2011), apparently on Canada's housing market. Coincidence Carney is speaking in Vancouver about the housing market? You decide!

Carney's speeches are important because they have provided substantive hints at future directions of government policy, not only overnight lending rates on which his bank has direct influence but also on auxiliary government policies that affect economic growth in the medium term. One such area of concern recently highlighted by Carney has been the over-valuation of assets and elevated debt levels propagated by low interest rates, speculative bubbles, and international capital flows in Canada's housing market.

I will be eagerly awaiting the speech as I see it as providing key clues surrounding policy options for the federal, provincial, and municipal governments to quench speculative excesses in the housing market, at a time when interest rates are unusually accommodative. The speech is concurrent with ongoing OSFI investigations into banks' exposure to potential asset price bubbles (of which I touched on here). While this is a housing analysis blog and undoubtedly biased towards all things "housing", it should be made eminently clear that, in my view, an unstable housing bubble is the key risk in Canada's economic growth in the medium term and in the interests of all Canadians to ensure such a bubble is mitigated as efficiently and quickly as possible.

I will provide my thoughts on Carney's speech after it is distributed.

edit: it is rare that the Bank of Canada and Department of Finance diverge from bringing a common message. Here is the latest press release from the Department of Finance:

Among the important measures included in the Act are those to: ...Reinforce the stability of Canada’s housing finance system

- Strengthening the Government’s oversight of the mortgage insurance industry.

If it were me I would regiment that all low ratio loans be qualified at the 5 year posted rate, and that mortgage insurance be capped in markets where prices have deviated from incomes. My concern is that, like certain Asian economies, over-indebtedness is not necessarily limited to high-ratio loans, and current low-ratio loans may end up being tomorrow's high-ratio loans. Strengthening oversight may have to be extended beyond CMHC. We shall see!

Labels:

analysis,

bank of canada,

bubbles,

debt,

jesse

Monday, June 13, 2011

New Coat of Arms for Vancouver

Long-time commenter patriotz produced a new suggested coat of arms for the City of Vancouver:

The $888,888 is negotiable, of course.

Poster patriotz has provided invaluable insight into finance and real estate investment for as long as I have been reading Vancouver-based real estate blogs (2006). While the portent of a house price crash in Vancouver has not yet come to pass, it should be noted patriotz's core analysis of relating prices to rents from a pure investment perspective regardless of preference to own, has paralleled the analysis bandied about by the likes of US Fed economist David Altig and MSM-quoted blogger CalculatedRisk.

Searching for keywords "patriotz" of the comments on this blog and vancouvercondo.info is worth the effort for some top-notch "housing analysis".

Thursday, June 09, 2011

Vancouver Rental Market Update April 2011

An important component of the housing market is the available rental stock. If inadequate housing is being built we should expect low vacancy rates and increasing rents. CMHC released its survey (press release here) on monthly rents and vacancy rates for various parts of the country. Overall vacancy rates have declined in Canada, but Vancouver and BC? Mmmm... not so much.

Rental market conditions eased across British Columbia housing markets in April 2011, in contrast to most other rental markets in western Canada. The supply of rental units increased as people moved from apartments in purpose built rental buildings to other forms of housing, including homeownership, secondary rental units such as investor-owned condominiums or secondary suites. Favourable mortgage interest rates combined with an ample supply of homes listed for sale for home buyers to choose from and a more stable economic outlook, drew some renter households towards ownership during the first quarter of 2011. The effects of this forward buying are reflected in higher vacancy rates in the province’s more expensive urban housing markets.Other factors affecting demand for rental accommodation include immigration and youth employment levels. Immigration continues to support rental housing demand, as recent immigrants tend to rent first before becoming homeowners. However, recent data show that the level of immigration to British Columbia dipped in the fourth quarter of 2010, pointing to moderating rental housing demand. During the first four months of 2011, British Columbia youth unemployment levels rose compared to levels recorded during the first four months of 2010. Lower levels of youth employment likely reduced household formation among young adults (under 24 years of age) who are predominantly renters, reducing demand for rental accommodation.The vacancy rate edged higher in the Vancouver CMA but remained relatively unchanged in the Victoria and Abbotsford CMAs. The movement of renters to homeownership continued during the later part of 2010 and into 2011, freeing up rental accommodation. As well, purpose-built rental apartments in these urban centres face increased competition from the secondary rental market, including secondary suites rented out by homeowners and investor-owned condominiums available for rent.

The CMHC report attempts to break down rents and vacancies based on region and on dwelling type, namely apartments, townhouses, detached dwellings, etc. based on number of bedrooms. Larger dwellings typically have higher vacancy rates than smaller ones and professionally-managed dwellings typically have lower vacancy rates than "amateur" dwellings.

Here are the numbers for "private apartments" (I'll update this as I fish out more data):

Vacancy rate

April 2010 2.2%

April 2011 2.8%

Availability rate (The availability rate measures the number of rental units which are vacant or for which the tenant has given or received notice to move and a new tenant has not yet signed a lease compared to the universe of rental units.)

April 2010 3.1%

April 2011 3.7%

Rents (CAD)

April 2010 978

April 2011 989

Change in rent

Apr-09-Apr-10 2.3%

Apr-10-Apr-11 1.6%

Consider these readings as the "core" rental market. CMHC has in the past attempted to measure non-core rentals, such as houses, basement suites, and privately-held condo units rented out directly by owners or through smaller property management companies. It appears this half's survey did not include those data. While the "non-core" data are interesting, it's difficult to ascertain whether they bring much statistically significant insight into setting housing policy. I expect if the "core" rental market is strong, so too should the "non-core" readings and, akin to core CPI, the core rental market can be used on balance to measure the health of the overall rental market.

The first item to note is that Vancouver usually has lower vacancy rates than outlying areas. When looking at cap rates for apartments, we should understand that an area with lower vacancy rates will carry a lower cap rate. Second CMHC notes (surmises?) that the home ownership rate increased in Vancouver through 2010 and the first months of 2011, meaning the "core" market faces a reduced tenant pool. Third it noted that there is decreased immigration into Vancouver than in past quarters.

I think one additional point is that, as I noted on vancouvercondo.info back in March, the outflow of temporary workers due to a federal government policy shift is starting to have direct effects on the rental market:

for Q1 2011 and potentially beyond there will be that many more dwellings looking for inhabitants, and perhaps this indicates a push by the government to get permanent residents, who are in sum suffering from elevated unemployment levels, back to work.

Backing up anecdotes I have been hearing online, the experiences of friends looking for accommodation in the Vancouver area, perusals of Craigslist, and my knowledge of landlords attempting to fill vacancies, this report should not come as a surprise.

This was a weak report for the property rental industry of Vancouver and BC as a whole. Note this trend is opposite to that seen nationally and is distinctly opposite to the direction rents are taking in the US.

Sunday, June 05, 2011

OSFI in da House

Warning: longish post dealing with mortgage lending. If you are having trouble sleeping, please read on...

The Financial Post has run a story on OSFI (Office of the Superintendent of Financial Institutions) taking an increasing interest in Canada's housing market (emphasis mine):

Canada’s top banking regulator is on a fact-finding mission to gauge the scope of foreign investment in residential real estate.Industry sources say the Office of the Superintendent of Financial Institutions is sizing up the market, most likely as part of its active campaign to “stress-test” the country’s big banks to measure how they would be affected by volatility in various market segments.OSFI is taking a broad look at bank exposure to household debt and how the financial institutions are monitoring loan portfolios amid growing concerns over the ability of Canadians to handle their debt load.In the case of the housing market, sources point to global trends that could affect investment in Canada — such as China’s recent policies to curb speculative real estate investment in that country — as evidence that Canada is operating in a fast-changing market that could be adversely affected by decisions made in other countries.They suggest OSFI wants to know how big a factor foreign investment in Canada’s housing market is, and how big it is likely to become, so the regulator can measure the potential impact on banks if demand were to dry up.“It’s something they are trying to get information on,” said a source close to the situation. “It’s not something they can find out so easily.”Rod Giles, a spokesman for OSFI, said the regulator does not comment on specific supervisory actions, but he confirmed that the “housing market including real estate linked lending activities” is among a set of “emerging issues, risks and markets across the Canadian financial system” that is being monitored by the Ottawa-based regulator.

I'm not sure the concentration on foreign ownership is the biggest story. It might be for all I know but OSFI seems to be taking a much broader look at bank lending (and likely non-bank lending too, as much as it is able) to ascertain how at risk banks -- and households and government -- are to house price declines. It is interesting to look at what OSFI is likely looking for in terms of the Canadian housing market. Some reasonable possibilities are:

- Total exposure banks have to falling house prices.

- Whether certain regions are contributing to large distortions on banks' balance sheets.

- Whether foreign investors are playing a direct part in leveraged speculative activity.

- What exposure governments may have to falling prices.

- What exposure homeowners may have to falling prices.

OSFI is likely gauging whether banks will themselves be in distress if prices fall nation-wide or in certain regions identified as being in a speculative bubble (like Vancouver). On this front it does not appear so, at first glance. Banks have little exposure to high ratio loans due to the requirement for mortgage insurance. Lower ratio loans are typically on 5 year or less terms so, for the most part, loans can effectively be called before prices drop drastically.

OSFI is likely also determining how exposed the entire economy and the government will be to dropping house prices. CMHC-insured loans are required to have borrowers qualify at the posted 5 year rate even if they take a variable rate mortgage. However there is no explicit requirement that the same longer-term diligence is performed with low-ratio mortgages. According to a mortgage broker friend of mine banks will often qualify people at the variable or "blended" rate for TDSR/GDSR.

On this front, OSFI has some reason to be concerned for homeowners and the government. When rates rise, homeowners may have trouble qualifying at elevated rates. Banks will effectively call the loan on renewal, require mortgage insurance or, in some cases, foreclose or instigate a homeowner to sell on a short timescale for those who don't qualify at the 5 year mortgage rate. In this scenario, the mortgage market experiences a "squeeze" as few will be able to qualify at the higher rates and CMHC-insured loans increase in prevalence as borrowers see their equity vanish. Either way there is incentive for the government to step in with a higher level of guarantee or risks a replay of the credit squeeze of late 2008 and early 2009.

What could OSFI recommend? When it comes to reducing government exposure to falling house prices, OSFI would likely be looking closely at how well TDSR/GDSR for borrowers match up with the 5 year mortgage rate. If there is a discrepancy, I expect some arm-twisting to ensure banks' future loans of all terms can be smoothly transitioned to any other term length.

OSFI could also regiment lending in other ways; for instance, touted recently by Mark Carney in a recent paper (PDF) (hat tip commenter RP1 on The Economic Analyst), using countercyclical capital buffers (where banks are required to keep larger capital reserves when private debt ratios are elevated from their long-term average). It would certainly be embarrassing if the Bank of Canada's governor would preside during a situation of high private debt ratios, experience a subsequent house price crash and concomitant fallout, all without said beneficial countercyclical reserves in place.

See also:

Labels:

bank of canada,

banking,

interest rates,

jesse,

mortgage,

osfi

Thursday, June 02, 2011

Mortgage Renewal Gap

Blogger VHB used to post the so-called "renewal gap", the difference between current mortgage rates and rates "N" years ago, where "N" is the mortgage term. So here it is, updated to May 31, 2011:

Note the 3 and 5 year rates are still at negative gap, meaning that homeowners renewing their mortgages today can receive lower monthly payments, and this has been the case for just over two years now.

Why is the renewal gap important? The gap indicates how much financial relief current homeowners can receive when they renew. As we can see, until the end of 2008, the renewal gap was positive. Since then the gap has been negative for the past few years this means that cohorts of mortgage holders have been receiving relief in the form of lower monthly payments for close to 3 years now and counting.

With some consensus that rates may start edging up as the economy improves and employment reaches towards full capacity, it is worth looking at what could happen to the renewal gap in years ahead. To help with picturing this, I have extrapolated mortgage rates at a high and low end: at the low end assuming "flat" rates for the next 3 years, at the high end assuming a linear extrapolation to the "max" mortgage rate seen in the past 10 years in mid-2014, as shown below:

So the scenarios play out as follows. First the "flat":

- 1 year renewal gap stays around zero, as we would expect

- 3 year renewal gap approaches and stays at zero by early 2012

- 5 year renewal gap stays negative until early 2014

And "max":

- 1 year renewal gap moves up to and remains at 1% starting the second half of 2011

- 3 year renewal gap shoots positive by early 2012 and trends even higher until 2014

- 5 year renewal gap stays slightly negative but "shoots" up positive in early 2014

There are other scenarios, of course, but if one believes the Bank of Canada's statement, that the recovery will be "sluggish" in the coming years, I have chosen a "sluggish" return to full capacity. Of course if the elusive bond vigilantes rear their heads, all bets are off.

Labels:

analysis,

bank of canada,

debt,

interest rates,

jesse,

mortgage

Wednesday, June 01, 2011

Putting 贰 and 贰 together

A flurry of interesting things happened earlier this week, though none should be a surprise for anyone familiar with local real estate bear blogs, forums, and their commenters.

the Bank has decided to maintain the target for the overnight rate at 1 per cent. This leaves considerable monetary stimulus in place, consistent with achieving the 2 per cent inflation target in an environment of significant excess supply in Canada. Any further reduction in monetary policy stimulus would need to be carefully considered.

From May:

the Bank has decided to maintain the target for the overnight rate at 1 per cent. To the extent that the expansion continues and the current material excess supply in the economy is gradually absorbed, some of the considerable monetary policy stimulus currently in place will be eventually withdrawn, consistent with achieving the 2 per cent inflation target. Such reduction would need to be carefully considered.

And they went out of their way to now state this:

The possibility of greater momentum in household borrowing and spending in Canada represents an upside risk to inflation.

OK so we know that high levels of borrowing based on inflated asset values is a problem, and was one of the major reasons why the Department of Finance announced changes to CMHC mortgage insurance policies implemented earlier this year. While this would in and of itself reduce the rate of borrowing it does not tell us whether or not the rate of borrowing is declining as expected. The Bank of Canada, after analysing the evidence, thinks more needs to be done.

Then we get this report from Colliers president and managing partner Greg Ashley:

There also seems to be more myths than facts about Mainland Chinese investing. This trend is certainly impacting single family housing values in Vancouver - West and Richmond. However, it is not the driving force behind all sales. For example, a number of the recent launches reported large numbers of Asian buyers. Yet a signiicant portion of these buyers are actually local residents not foreigners. That being said, foreign demand is having a positive impact on multi-family sales and the debate will continue.While restricting foreign ownership may curtail this demand it may also have the unintended negative consequence of hindering the development of much needed new housing elsewhere in Vancouver. While debate is healthy, restricting foreign investment will not only afect our real estate market, development industry, housing supply and our economy it may also damage how we are viewed in the world. Personally, I’d rather live in a place that is envied and sought after by people all over the world: a place that is welcoming, accepting, tolerant, inclusive, multi cultural and beautiful.

Again with the foreign ownership restrictions! Who asked him anyways? So let's for argument's sake say that the Colliers data, and Bob Rennie's statements, on foreign ownership are correct and foreigners indeed are not buying much. Who is buying, exactly, if not foreigners? The answer, obviously, is locals, or at least those who have some semblance of local ties through their immigration.

So now we come to it. The Bank of Canada, for whatever reason, is worried about debt growth and we have some reasonable indication that foreign ownership is not significant. I will be so bold as to put two and two together and state that, as I have mentioned previously, Vancouver may have not read the memo from the Department of Finance that Canada's debt levels are too high.

I agree that restricting foreign ownership in and of itself is a bad idea, insofar as the data simply don't support foreigners wagging the tail of the dog. But there is an argument that tamping the perception of boundless future foreign and immigrant investment may go a long way to ground future price expectations, though this is by no means a sure thing. Nonetheless, in my view a more plausible explanation for "ludicrous" prices is that marginal local buyers have bought into the "myth" of boundless immigration and foreign investment supporting higher future valuations, and they are going into debt to do so.

Am I off base in thinking locals taking on debt is really what's going on?

Labels:

jesse,

real estate insanity,

richmond,

speculation,

statistics,

vancouver

Subscribe to:

Posts (Atom)