" We are never deceived; we deceive ourselves."

- Johann Wolfgang Von Goethe

An old adage is that if two people tell you you’re drunk, you’re drunk. After repeated conversations with friends, co-workers, and family, I can safely say that I am nicely and completely hosed. Most of my social circle does not believe as I do Vancouver house prices are going to drop at least 40% from their peaks in 2008. From this, being a humble sort, it would be incredibly arrogant of me to think them collectively wrong.

Here I offer the wildly arrogant possibility that maybe -- just maybe -- “they” are wrong.

Vancouver is a city obsessed with real estate. Many cultures immigrating here cherish it above little else; prices have risen significantly in inflation-adjusted terms for a generation; the majority of homeowners have huge swaths of equity tied up in property. It is hard to make the case for why the real estate party is closing down for a long time. I have tried, of course, citing low immigration, low median incomes, flat rents, huge looming inventory, dependency upon construction employment, a global recession, negative savings rates, significant similarities to US markets now crashing hard, arguments with which real estate “bears” are familiar. All my arguments, it is rebutted, are short term phenomena which will pass in a few short years and Vancouver will continue with its price appreciation as it has done since it was founded.

I believe Vancouver is in a bubble. Not a house price bubble (though we are), but a bubble of collective dissonance when it comes to how to value real estate. The 800 pound gorilla in the room is the simple question: why are properties worth what they are?

There are several ways to answer the question. The first most obvious answer is simply that properties are worth what someone else is willing to pay. Fine, but that doesn’t get to the heart of “why”. Why is that someone else willing to pay? Who cares, we say. Who are we to second guess motives of buyers? Maybe there is a new batch of rich buyers who care not whether an investment produces a reasonable income stream, maybe population growth is forcing land prices up, or maybe future income growth will more than compensate for the prices we pay today.

Maybe so but the analysis of the data suggests we should care a great deal why others are willing to pay and not just stop at our whimsical assumptions about what Vancouver is. Rich immigrants? Not too many. Population growth? Not that high. Income and rent growth? In real terms, try the opposite. Running out of land? The number of residential projects under construction is near all-time highs. It is clear to me that the image of Vancouver being a playground of the rich with high immigration, rising wages, and a limited land supply is for the most part illusory.

If we go back to the question, why is property worth what it is, using the actual data, the results are all the more concerning for real estate bulls.

There is a strong case that Vancouver real estate, like other cities around the world, has been riding a generational bubble. It has fostered a “can’t lose” attitude, where stomach-churning drops are assumed to quickly recover to new highs. In the past 25 years Vancouver has spent relatively short periods in the price valleys with relatively long periods of over-valuation. This is classic speculation with a twist. The length of speculation and perpetual volatility has perversely led to survivorship bias and, due to the relatively slow movement of property markets, deification of successful real estate investors embedded in local social circles. The speculation has not been the flash in the pan we all connote with other booms but a slow and seemingly secular trend to permanently high prices. It has fostered an air of invincibility around real estate investing, still heavily present today. How about those stories we hear of flippers losing their shirts on presale assignments? They are merely unfortunate and limited casualties in the machinations of the city’s real estate juggernaut. It has been a mistake to count out the Vancouver real estate owner, say the successful surviving real estate gurus.

We are now in the throes of another wave of high volatility with a decided trend downwards. At first glance it looks the perfect storm: oversupply, low sales, high prices, a global recession, and tighter lending, all point to prices falling more. Even with these insurmountable odds speculators will still be playing in the market, ever aware of Vancouver’s amazing ability to rebound from previous crashes. I hear it constantly: prices have dipped and will stabilise in 2010, the recession will be over by the end of the year, in-migration of rich families will eat up the excess inventory quickly, et cetera. Almost certainly there will be people buying this spring anticipating new highs within a decade. The same will happen in 2010, 2011, 2012, and on, all the way down and up again. This does not mean these buyers would support prices from falling but it does mean there are still bulls in any active market (by definition, in fact).

I have heard several comments from those bearish on local real estate that prices supported by rents and incomes will happen in but a few years, amounting to a truly meteoric, though not unprecedented, fall from grace. I am not so sure. The mood of Vancouver is so tilted towards the sanctity of real estate investing I find it only convenient to think a handful of years of a bear market changes this thinking. If anything I see years of pain to change how people value real estate, likely more than five or even ten: the “stickiness” of prices we hear so much about. This does not preclude significant price drops in the next few years -- I personally think it likely -- but to really get to a point where affordability is restored could take much longer.

So why is real estate priced as it is? What would we say after a crash and the subsequent fallout? I can hear it now: real estate, in its essence, is but a utility, providing a service for a fee like a car. Affordable, not unaffordable, housing supports income and economic growth. Property is only worth what income it produces. Dare to dream, drunk jesse.

The past generation has done well from real estate investing and I believe its perpetual success has fostered a deception -- a cognitive dissonance -- about what real estate really is and how it is valued. The deception is so complete it is terrific. While high prices may continue, there is a real and plausible possibility of a slow and painful trudge towards lower prices for a long time.

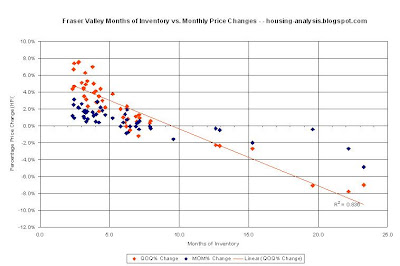

(Note: This graph is not endorsed by the REBGV.)

(Note: This graph is not endorsed by the REBGV.)