It is rare a mainstream media commentator has cut through the plethora of myths surrounding real estate investing AND writes something I agree with. Until Tom Bradley wrote

this piece in the Globe and Mail.

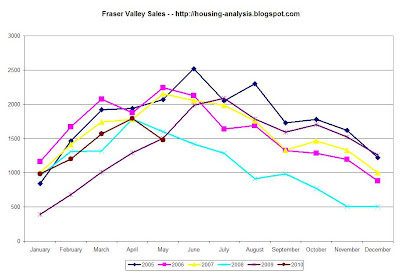

We’re starting to see stories about a softening real estate market in Canada. Listings are up, sales are down, and even the always bullish industry executives are predicting lower prices in the coming year.

It reminded me of a quote I saw recently: “Real estate is the drunk driver on the economic highway.” This statement, attributed to Tom Barrack, the CEO of real estate investor Colony Capital, speaks to the fact that residential real estate can be volatile. Yet that same volatility highlights why it can be fertile ground for a disciplined, patient investor. There are a number of reasons for this.

First off, it’s cyclical in the best way – the cycles are generally long while memories are always short. The most recent trend, up or down, is assumed to be sustainable. For an investor willing to take a longer view, this is a good thing.

Second, real estate is a topic that produces lots of “armchair” experts. Despite a lack of rigorous analysis, views are strongly held and overconfidence is rampant. Again, this is good for someone who is less entrenched and has a broader perspective.

No argument, really. The first point is borne by the extensive analysis on this blog, where we have shown price movements are highly correlated to relative, not absolute, pricing. I certainly cannot argue the second point, being one of said "experts" myself.

Despite these attractive investment features, there are reasons why I don’t invest in real estate beyond my personal needs.

Hm. Now that really got my interest. He explains:

For one, I have a day job, and this type of investing is time intensive. It also doesn’t help that transaction costs are extremely high (commissions, legal fees and taxes), and there are significant carrying costs.

...

Because leverage is involved, real estate prices are sensitive to changes in interest rates. Purchases are often financed up to 90 per cent with debt, so mortgage payments are a key factor in determining prices.

For almost 30 years, we’ve been in a bull market for interest rates and with every tick down, property values have gone up. Given that we are somewhere near the end of the rate declines, investors have to recognize that a huge tail wind is swinging around.

So for one he doesn't have the time, or at least recognizes that real estate investment, even when many management duties are outsourced, still has a large time and cost component for the investor. In Mr. Bradley's case, his hourly chargeout rate is likely way higher than many investors.

The second point is more interesting. He's saying that recent valuations have been inflated by riding a decades-long secular trend of decreasing interest rates. Further gains due to this interest rate arbitrage are unlikely and could well reverse over the course of another few decades.

House owners deploy a strategy that is at the core of hedge fund investing – buy long-term assets with short-term financing. The strategy dials up the investment’s return potential, both on the upside and downside.

I think that's a key assessment. It is a monumental mistake to assume that short term financing rates will prevail indefinitely. Even if rates remain low, it is not a savior for prices: low rates in perpetuity imply incomes are stagnant or falling on average.

Read the full article. Understanding his basic tenet -- that real estate is in its essence a capital purchase with decades-long amortization -- is well worth a pause for consideration before investing in real estate in the current climate.

Hat tip to Tom on

VCI

Next, immigration. Immigration is doing fine. We are at the same level in terms of number of bodies that we reached in the mid 1990s. As a percent of population, it is lower than the mid-90s.

Next, immigration. Immigration is doing fine. We are at the same level in terms of number of bodies that we reached in the mid 1990s. As a percent of population, it is lower than the mid-90s. Combine these together and throw the natural growth (births - deaths) into the mix and you get total pop growth. Here it is. For new bodies, we have a cyclical peak in the late 90s, but lower than previous cyclical peaks. As a percent of population, however, this cyclical peak was around half of previous peaks--and lower than previous troughs!

Combine these together and throw the natural growth (births - deaths) into the mix and you get total pop growth. Here it is. For new bodies, we have a cyclical peak in the late 90s, but lower than previous cyclical peaks. As a percent of population, however, this cyclical peak was around half of previous peaks--and lower than previous troughs! How remarkable the 2000s were for population growth can be made clear by ranking the 5-year periods from 1960 to 2009 by population growth. 2000-04 and 2005-2009 were dead last. So much for the population boom.

How remarkable the 2000s were for population growth can be made clear by ranking the 5-year periods from 1960 to 2009 by population growth. 2000-04 and 2005-2009 were dead last. So much for the population boom.