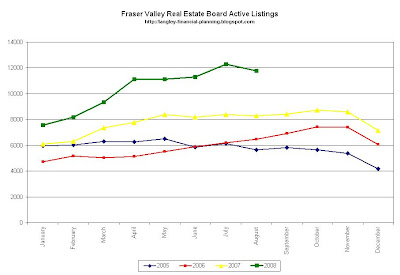

Active Listings in the FVREB ended August at 11,770 homes for sale.

There were only 910 sales in the entire FVREB area during the month of August.

This meant that the Months of Inventory rose to 12.9 months which means that the sales to listings ratio in the FVREB was 7.73% during the month.

As the ball is now rolling on negative price changes, the correlation between the supply and demand metrics and the corresponding price changes is 'uncanny' to put it simply!

And yes, prices fell 0.1% from August 2007 according the the Real Estate Board's benchmark House Price Index.

Love the charts! That sales to actives ratio is a killer.

ReplyDeleteI'm still surprised there wasn't a drop in average SFH price from July. OTOH that 5.6% drop last month would be tough to follow. So call it a 3.5% drop over two months. Here's to another dip in September!

What's really fascinating about this is the shift in public/media perception. With Vancouver sliding, and Victoria average prices down $80k since the spring, a small SFH uptick in the valley no longer registers.

See, Mohican, you should've waited.

ReplyDeleteThanks Mohican - I'm surprised at the lack of comments and wanted to give you some positive feedback.

ReplyDeleteCheers,

Ben

I think it goes without saying that these charts are VERY appreciated, but I'll say it anyway :) The MOI and Sell/List graphs are shocking.

ReplyDeleteThank-you Mohican. It must take a lot of effort to continue even after you have finally purchased a home. The rest of us really appreciate it.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteIndeed brilliant to see these numbers and vastly appreciated from over here in Victoria, where we look to you guys for a more complete picture of where this market is headed!

ReplyDeleteCheers

Sam

Also chiming in with thanks.

ReplyDelete